Austin's Latest Housing Highlights: Rate Drops, Unexpected News & What It Means for 2024

Did you hear the BIG news?!!? In the latest turn of events, contrary to expectations, mortgage rates have not experienced an increase. In response to the Federal Reserve's meeting yesterday, we witnessed a notable decrease in rates by 0.27%. This shift presents an intriguing scenario for our real estate landscape, especially as we look towards the promising prospects of 2024, which is expected to see a cumulative rate cut of 0.75%. This news offers a ray of hope and a potential boost for both buyers and sellers in the coming months.

🌱 Spring Market: A Season of Renewed Hope

In a surprising and welcome development, mortgage rates have not risen as anticipated. In fact, following the Federal Reserve's latest meeting, rates took a significant dive, dropping by 0.27%. This shift brings a breath of fresh air to our market, hinting at an even brighter outlook for 2024, with expectations of a 0.75% rate cut. This change is poised to inject new vitality into our spring market, offering an opportune moment for both buyers and sellers.

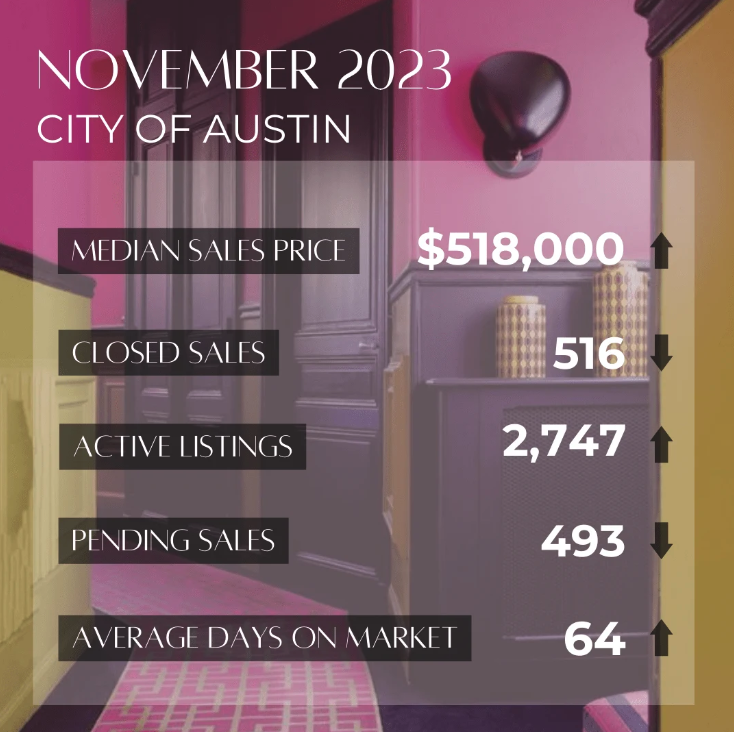

🏡 Austin's Real Estate Pulse

Let's delve into the current landscape of our beloved Austin. According to the Austin Board of REALTORS® November 2023 Central Texas Housing Market Report, there's a noticeable shift in the winds. The median home price in the Austin Round-Rock MSA has seen an 8.4% decrease to $424,450. This adjustment signals a growing availability of homes at more accessible price points, albeit still higher than pre-pandemic levels.

Interestingly, the total sales inched up by 0.2% to 2,065 homes, a subtle yet telling sign of market resilience. With a more diverse selection of homes, buyers now find themselves in a better position to find their dream home.

📉 A Closer Look at the Numbers

With the elevated mortgage rates this fall, November witnessed a 5.7% dip in sales dollar volume year-over-year. Homes lingered a bit longer on the market, averaging 75 days, an increase of 18 days from last year. However, this has led to a healthier inventory, rising to 3.7 months. New listings jumped by 11.6%, while active listings and pending listings saw a respective increase of 7.2% and 9.2%. This trend is not just a relief for eager buyers but a sign of a more balanced market.

🌟 The Silver Lining

As Dr. Clare Losey, a housing economist at ABoR, points out, the moderation in home prices, coupled with the recent dip in mortgage rates, is set to enhance affordability as we venture into 2024. This is indeed promising news for those looking to buy.

🏘️ Looking Ahead

With the Austin City Council's Phase I of the Home Options for Middle-income Empowerment initiative, we're set to see more housing options for residents, balancing homeownership and rentals. It's a step forward in addressing our housing needs and ensuring a vibrant, inclusive community.

🌼 Embracing the Spring Market

As your trusted real estate advisors, we are here to guide you through these dynamic times. Whether you're planning to buy, sell, or simply explore your options, our team is ready to provide the expertise and support you need.

Let's embrace this season of change together, making the most of the opportunities it brings. Let’s connect to discuss how these developments impact your real estate goals.

With Love from ATX,

Khani Zulu Group